Facilitating RWA Tokenization Management

BitGo RWA provides modular integration options across our various solutions which support the end-to-end lifecycle of an investment.

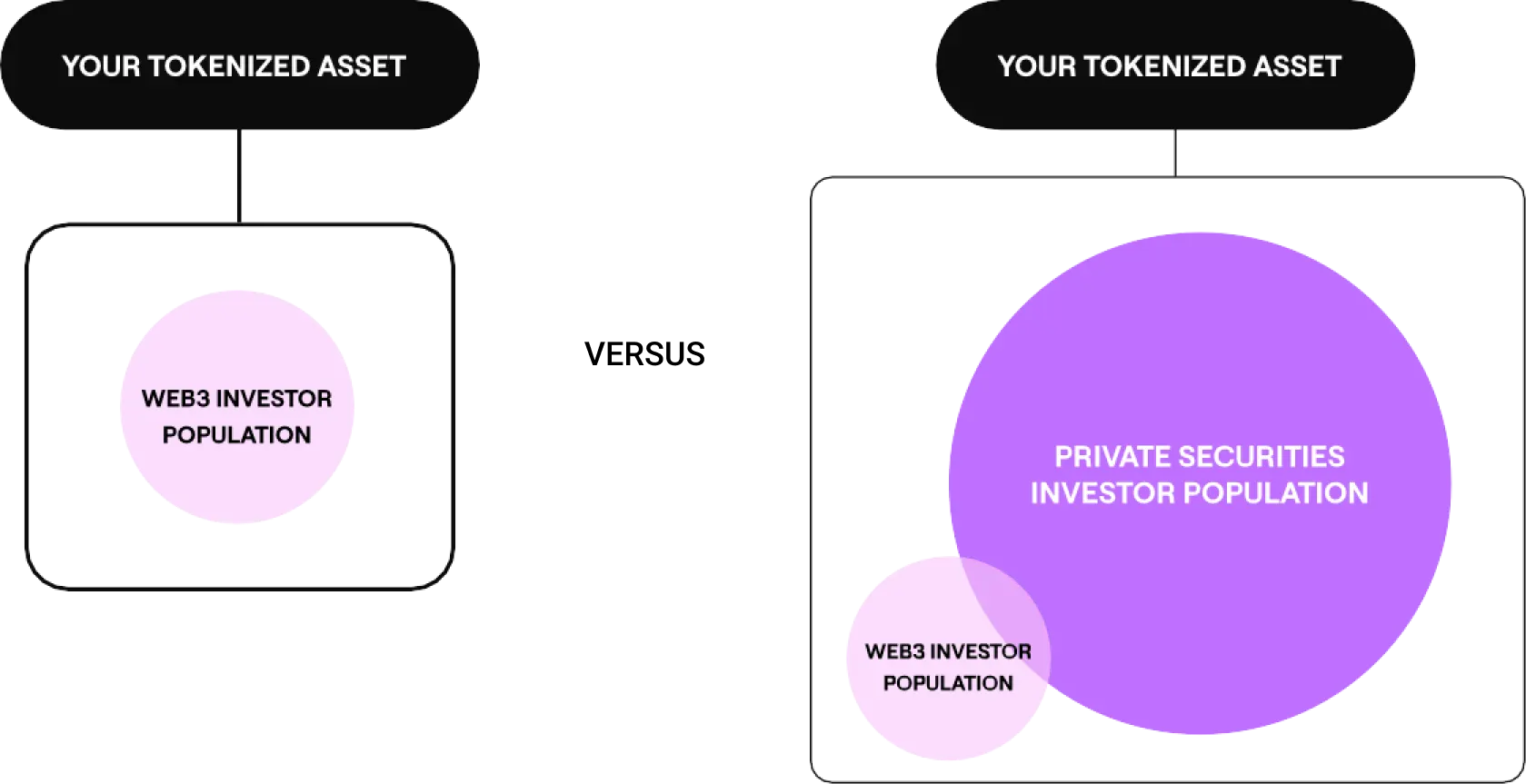

Current Landscape

Companies raising capital (issuers) and investment platforms are piecing together different Web2 and Web3 components to tokenize assets that they believe are attractive investments. Platforms often lead with a Web3 experience at the expense of the investment's fundamental merits and broad accessibility.

Our Solution

BitGo RWA leverages BitGo's proprietary alternative asset custody solution to provide a platform that unlocks the actual advantages of tokenized assets while maintaining the convenience and broad accessibility of book-entry securities.

Our solutions don't require investors to open and interact with blockchain wallets, manage secure asset custody, or sign cryptographic transactions -- unless they choose to.

Our solutions enable a more familiar experience for the average investor. Unlike other available solutions that enforce vertical integration, BitGo RWA provides modular integration options across our various solutions which support the end-to-end lifecycle of an investment. Simply put, use only what you need.

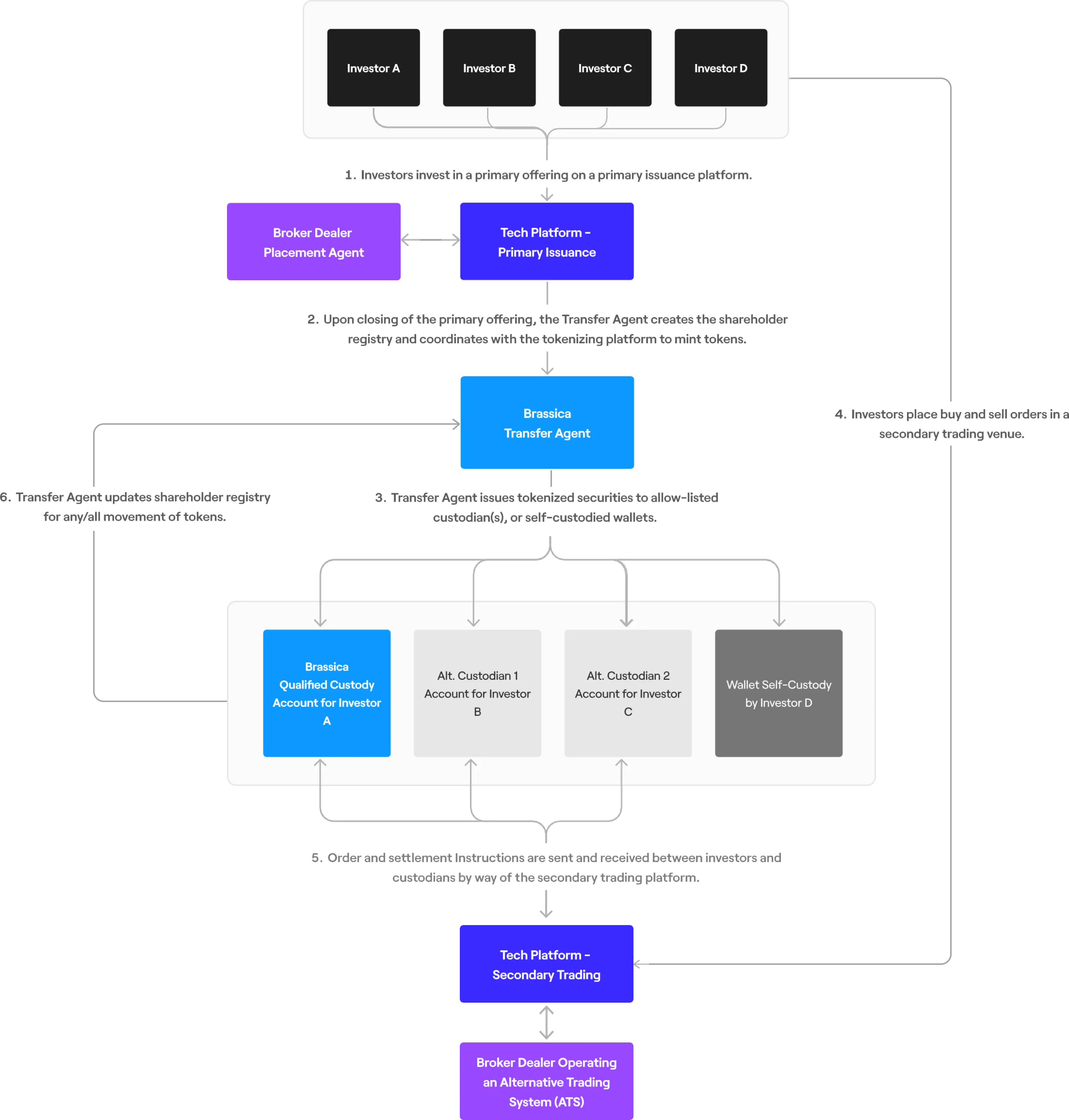

Lifecycle of a tokenized security with BitGo RWA

OVERVIEW: BitGo RWA is there from the first minting, with full interoperability.

BitGo RWA provides the backbone for the entire lifecycle of tokenized securities. Leveraging our proprietary technology, regulated services, and integrated industry partnerships, we'll facilitate the design, minting, distribution, custody, and tracking of securities tokens.

BitGo RWA's API-first solutions prioritize compliance and seamlessly embed into and operate with virtually any investment platform, Alternative Trading System (ATS), custodian, or placement agent.

1. Friction-Free Primary Issuance

BitGo RWA's securities issuance and investment workflows allow an investor to make an investment commitment, pay for it, and receive tokenized securities once an offering closes. These services include payment rails, contract e-signing, escrow services, and funding reconciliation.

BitGo RWA provides these Capital Formation services to enable securities offerings that are compliant with US law, whether the securities are registered with the SEC or offered under an exemption.

2. Regulated Record Keeping

BitGo RWA's SEC-registered Transfer Agent is the official tokenized securities record of ownership, whether held in self-custody or with a regulated institution.

BitGo RWA's Transfer Agent controls the allow list for all eligible wallets, which enables our programmatic solution to track inter-custodian and peer-to-peer transfers, while ensuring compliance with regulatory and issuer-imposed restrictions.

3. Qualified Custody of Tokenized Securities

While there are real benefits to securities in tokenized form, not everyone is comfortable with blockchain wallets and private keys. Companies can use our APls to create a familiar Web2 user experience where an investor can open a BitGo RWA multi-asset custody account to hold their tokenized securities, catering to investors who don't desire a Web3 experience.

Moreover, certain institutional investors and money managers may be required to hold securities positions with a Oualified Custodian versus holding client assets in self-custody. BitGo RWA's solution also accommodates investors who prefer to self-custody tokens in their own blockchain wallet, hold their own private keys, and sign their own cryptographic transactions.

4. Distributions

Many alternative investments today offer both value appreciation and income generation through dividends, interest payments, revenue share, and royalty payments. Stablecoin payments are especially useful for smaller cross-border distributions that are otherwise impractical to send using fiat payment rails.

With BitGo RWA's Paying Agent solution, issuers can efficiently distribute investor payments using stablecoins like USDC, while leaving the tax reporting burden to BitGo RWA.

5. Liquidity

In the world of tokenized securities, blockchain does not magically create liquidity for otherwise illiquid assets. Real liquidity comes from a market that is accessible, efficient, and trusted by the broadest set of participants.

BitGo RWA provides the infrastructure for regulated trading venues (i.e., ATS operators) to interface with regulated custodians which enables buyer and seller to settle both intra- and inter-custodian and without requiring investors to sign any cryptographic transactions. This mitigates the complications of gas fees and long settlement times. Our Qualified Custody multi-asset accounts leverage BitGo's Go Network and our programmatic Transfer Agent to prioritize interoperability between all market participants regardless of their familiarity with Web3.

How it works

Summary

Investors buy securities to build wealth based on the investment merits of the asset itself, not the technical infrastructure that supports it. Whether securities ownership is represented by a token, physical certificate, or a book-entry in a ledger, investors want to know the issuer and its securities are legitimate, and they're being offered to investors in a manner that is consistent with SEC rules. Investors should be able to hold the securities in an account with a Qualified Custodian where they're secure and accessible.

Issuers focused on the blockchain mechanics of their tokenized securities is like printing stock certificates on scented paper. BitGo RWA handles the infrastructure so the issuer, its agents, and investors can stay focused on the value of the investment asset, not the "paper" it's printed on.

WHAT WILL YOU CREATE?

Start building with BitGo RWA today.

Simplify the investment process and make alternative assets easily accessible to all suitable investors, unlocking a world of possibilities for investors and businesses raising capital.

Looking for a customized service solution?

We offer a wide range of capabilities that can be tailored to your

requirements.

To learn more contact us at

sales@brassicafin.com